In Long Island, a sinister trend is taking root—housing scams that prey on the vulnerable, leaving a trail of financial ruin and distress. As the demand for affordable housing grows, so does the cunning of scammers looking to exploit those in desperate need.

According to the FBI, in 2021, more than 11,500 people nationwide reported losing over $350 million due to rental and real estate scams, a 64% increase from the previous year.

House advocates say it is essential to understand the typical patterns of housing scams. Scammers exploit the urgency in tight housing markets, preying on the desperation of those seeking shelter.

The grim reality

Ian Wilder, executive director of Long Island Housing Services, said housing scams become even more prevalent during economic downturns. “We saw probably the highest number of scams the first time there was a market crash in 2009,” he said.

Like many regions in the U.S., Long Island becomes a breeding ground for scammers during times of financial instability.

To confront this alarming trend, Long Island Housing Services adopts a three-pronged strategy, according to Wilder.

The first suite of services targets tenants, providing them with information and access to housing counselors at no cost. Wilder emphasizes that this initiative empowers tenants with resources and avenues to reclaim funds if they’ve fallen victim to scams. It’s a direct and practical approach to assist those in immediate need, he said.

Another tactic directs the nonprofit’s efforts toward individuals in foreclosure, a group often targeted by scammers making false promises. Long Island Housing Services helps to ensure that individuals facing foreclosure receive the support and advice needed to navigate these turbulent waters and avoid falling prey to fraudulent schemes.

The third suite tackles fair housing issues, recognizing that specific demographics are more vulnerable to scams due to discrimination or other factors. Wilder said, “People are targeted because they are in an oppressed group, either because of discrimination or because scammers feel they can take advantage of them more easily.”

The web of deception

Understanding the typical patterns of housing scams is crucial in developing effective countermeasures, Wilder said. “They [scammers] know people are anxious to act quickly, and they feel if they don’t act quickly, they’re likely to lose an opportunity,” he said. Scammers exploit the urgency in tight housing markets, preying on the desperation of those seeking shelter.

Tom Bertino, the father of a Stony Brook student, shared a disheartening experience after viewing a rental post on Facebook in the fall of 2023. “My son and I were looking for a place for him, and everywhere we checked, there was a huge broker fee attached to the lease, usually equal to a month’s rent,” he said. Bertino continued, detailing a distressing incident where his son signed a lease without inspecting the room, only to discover significant issues upon arrival.

“My son signed a lease without being able to see the room because the door was locked when he drove 6 hours to see it. When we finally saw the room the day we were moving him, the walls had mold growing in them. My son did not move in and lost the first month’s rent of $1,000. Then, the landlord refused to give it back to him. There seems to be a lot of predatory renting going on,” he said.

The Suffolk County Police Department issued a warning, shedding light on indicators of potential scams. The warning alerts residents to be cautious of emails with numerous spelling errors, excessive use of capital letters, God, and references to overseas ventures. Recognizing these red flags becomes imperative in the battle against housing scams.

“Students themselves who may have less experience renting housing are a target for these schemes,” Wilder said.

Recognizing how the long-term effects impact victims, Wilder urged potential renters to approach enticing offers with skepticism: “If it’s too good to be true, it is.”

How a Nigerian scammer exposed himself

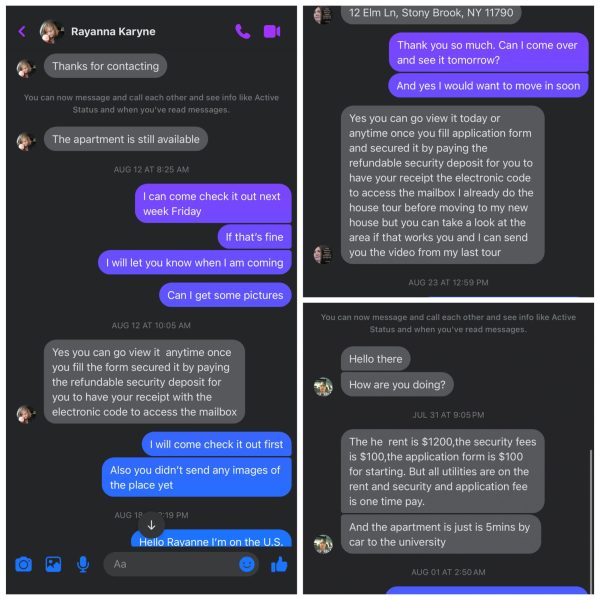

Browsing through a Stony Brook housing page, a post about a two-bedroom caught a user’s attention. She contacted the person who identified themselves as Curry Kim, who had shared the post. She was directed to someone Curry Kim claimed to be the landlord, and it soon became apparent that it was a scam.

The following day, a message arrived, starting with “Good morning, ma.” Despite its seemingly polite tone, it confirmed suspicions. The excessive respect and the use of terms like “sir” pronounced as “sa” and “madam” as “ma” revealed a distinctive Nigerian trait often associated with some scammers. This person wasn’t a white woman, but a Nigerian man.

Spen Manlangit, brother to two Stony Brook students, was in the same Facebook forums she was exploring. “Loads of scammers here,” he wrote in a post. “My sisters are still on the hunt for an apartment. We almost got scammed. I went to the address, only to find out it belonged to someone else, and my surprise, his place wasn’t up for rent.”

His frustration resonated with others in the group; one member said, ‘Not surprised, seen a lot of scammers in this group… wish it was safer!’

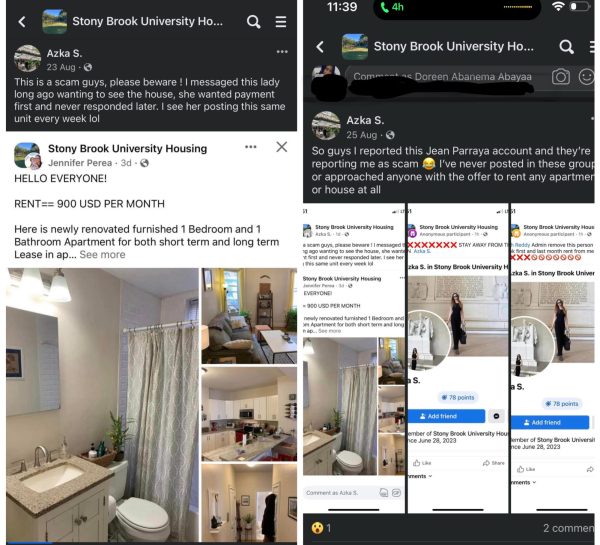

Another user, Azka S., who reported a scammer using the name Jennifer Perea, found herself featured on the page alleging she was a scammer too — a precaution she didn’t know would make her a target in this wild world of digital house hunting.

According to the Federal Trade Commission (FTC), social media has recently become a gold mine for scammers. More than one in four people who reported losing money to fraud in 2021 said it started on social media with an ad, a post, or a message.

The emergence of social media and online classified platforms has shifted the battleground for law enforcement to fight housing scams. Fraudsters now have a playground in various property listing websites, Facebook groups, and Craigslist, where they can deceive unsuspecting victims. The tactics they use have also adapted to the era.

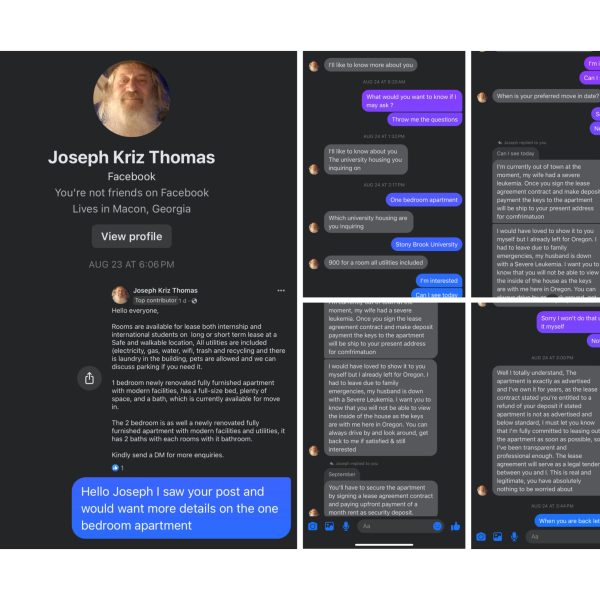

Contacting over 30 supposed landlords or real estate agents revealed a disturbing trend. Many demanded deposits ranging from $100 to $300 upfront before scheduling property viewings. Shockingly, some of them were ready to disclose the location of the house key without any intention of meeting in person. Their justification? Claims of being out of town, promising to return weeks later.

Two prospective tenants, Sheng and Karin, shared their unpleasant experiences with finding accommodation through Facebook. They want to only be identified by their first names to avoid consequences because housing is hard to find.

Sheng moved into a room advertised as having favorable living conditions, but it was problematic. Reflecting on her experience, Sheng said, “It hurts a lot, especially for my mom.” The landlord’s persistent demands for additional funds whenever her boyfriend or mother stayed over inflicted not only financial strain but also caused immense emotional distress to Sheng.

Karin found a shared house — where tenants rent a room, floor or section of a house with other people — on the Stony Brook Housing Page for $750, but it had many issues, “The bathroom often had this problem of crickets. So many crickets. Even though I keep cleaning, like every two or three days, every time we use the bathroom, we wipe it off. So many crickets. It was disgusting,” she said. Additionally, mold in the bathroom presented a disturbing living situation, she said. And when she voiced her concern, Karin claimed the caretaker got aggressive with her.

The repercussions of falling victim to housing scams can not only be a setback, but can also disrupt their overall quality of life. Many tenants find themselves without a place to call home, while others bear the burden of financial difficulties. The emotional impact of being deceived can be long-lasting, affecting trust and well-being.

Wilder also acknowledged the limitations that it would be challenging to regulate websites advertising rentals, saying, “Maybe it would be good if there’s a requirement that there’s a piece of paper that’s the rental permit that tenants could ask to be shown.” The suggestion, he said, would address the challenges in regulating the online markets where scammers often lurk, proposing a practical solution to enhance transparency.

He urged individuals to seek help from professionals. He emphasized the “if it’s too good to be true, it is” principle, advising individuals to protect themselves from potential scams. “Seek out a Department of Housing and Urban Development (HUD) housing counselor,” Wilder added.

Suffolk County Police on the frontline

The Suffolk County Police Department issued a warning, revealing the extent of their involvement in tackling housing scams.

“The Suffolk County Police Department has received several inquiries from homeowners and real estate professionals,” a spokesperson said in a statement. Also, they urged residents to remain vigilant against evolving tactics. “There are other variations that will be used to lure potential victims.”

The warning drives home how tricky it is to prevent scams, recognizing that scammers can be pretty crafty in how they trick people. It’s like a constant game of cat and mouse, trying to keep up with the latest tactics scammers use to take advantage of people looking for a place to live.

According to Nikolaos Nikiforakis, a cybersecurity expert at Stony Brook University, scammers may underprice their listings to attract more views. “Users of these platforms should, therefore, be suspicious of listings that are below-market value and be extra cautious when interacting with the corresponding landlords,” he said.

He also pointed out that scammers are active worldwide, and Nigeria is recognized as a center for various online fraudulent activities. “The Western countries are targets because of the cost-of-living differential that allows scammers to sustain their scam attempts despite low success rates.”

A realtor’s perspective

Real estate agent Alejandro Pappadia said housing scams are not limited to any particular region or place. He said scammers are everywhere, and it is a persistent challenge that needs addressing.

Pappadia acknowledged that the high cost of living in New York has led to the prevalence of illegal apartments, contributing to the problem. He emphasized the importance of renters asking for permits when considering a place, as it empowers them to make informed decisions. He said, “If they care about that house, it’s probably best to get it themselves.”

Several states have taken measures to combat housing scams. For instance, California and Illinois has passed a law requiring landlords to provide tenants with a written notice of their rights and responsibilities. Similarly, Texas has established a hotline that tenants can call to report housing scams. New York is also home to these policies.

But the battle against housing scams on Long Island remains ongoing, and requires the diligence of organizations and individuals working to combat this sinister trend. Housing advocates highlight the importance of understanding the typical patterns of housing scams, identifying red flags, and adopting a comprehensive approach to create a safer housing landscape for all.

Emma • Jan 19, 2024 at 2:28 pm

Great report Doreen. Very detailed. The housing scam is a subject in my home country Ghana.